Legal Vendor Consolidation – Who Benefits? | LPI

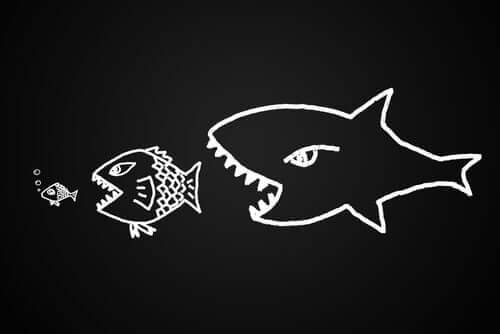

No doubt the owners of any new start-up will at some point dream of a wealthy suitor willing to pay generously to obtain rights to a dowry of intellectual property. But when this happens the question may also arise as to whom the marriage has benefited? Obviously, the owners of the start-up should be content with their exit, and presumably, the new owners will also be pleased (at least for a while), but what of the clients and the people who work for the company being acquired? Promises of efficiencies, scale, and operational experience aside, the primary purpose of any merger or acquisition is profit. Inevitably, past interests and principles must be sacrificed on the altar of savings and synergies. Some costs however may be borne by clients in the form of less favourable trading arrangements and loss of market power.

One past example in the technology sector is that of Cisco, which was once used as a university business case study. In fact, all the biggest companies in the technology sector – Apple, Microsoft, Google (Alphabet), and Facebook – have augmented growth through acquisitions. Beyond expectations that revenue should increase due to redundancies and the removal of a competitor, clients may however worry that the costs of market success will be reduced platform alternatives and an erosion of customer influence.

Regional sentiment

If a poll of Heads of IT in ANZ legal is any indication then the experience for most clients is hardly encouraging as from their perspective the outcome of a merger/acquisition leads, more often than not, to a deterioration in service, a decrease in innovation and an inevitable increase in cost. Simpson Grierson CIO, Valerie Fogg, believes there is a healthy degree of scepticism within the Legal CIO community about the recent consolidation of vendors. This is because smaller vendors are usually easier to deal with and can be nimbler and more innovative as they are in control of their product development and not constrained by being part of a larger business.’ Legal firms are naturally small to medium-sized businesses and lack the buying power to influence tech suppliers that increasingly must succeed with size. With US entities playing the most active role of acquirers, ANZ firms accustomed to the ubiquitous SaaS subscription model also indirectly face exchange rate risk.

In the legal sector, two companies historically associated with the acquisition of other technology companies are LexisNexis and Thompson Reuters. While most LexisNexis acquisitions have been in the publishing and research space there have also been software acquisitions of CRM and Practice Management solutions. Thomson Reuters, created in 2008 when Thomson Corporation purchased British company Reuters Group, has subsequently made over 200 acquisitions, many with an accounting and legal focus. Their practice management system, Elite 3E, along with HighQ and SoftDocs, are three of the products that Australian Legal would mostly associate with Thomson.

Recent M&A

However, when it comes to recent mergers and acquisitions in legal, one company in particular has been setting the pace: PE-backed Litera Microsystems. In 2017, K1 announced that it was combining three leading document technology companies — Litera, Microsystems, and The Sackett Group — into a single business. Microsystems had previously purchased Xref, thereby merging two competing products, Contract Companion and Xref, into a single legal proof-reading solution. Litera had been developing their own proofreading tool, so within a short space of time, the market had been reduced from a choice of three to one. Although Contract Companion is an excellent product there is possibly less incentive to innovate when there is no longer any competing solution.

Since that 'merger’ Litera has also purchased Workshare and DocsCorp, both competitors in the document comparison space with Compare and CompareDocs respectively, and in August it also acquired Kira Systems, which provides machine learning contract search capabilities, as well as Concep, a provider of B2B relationship marketing technology for law firms, corporations, and professional and financial services.

Another provider of software to legal is Intapp, which also went through a period of rapid growth by acquiring The Frayman Group (TFG) in 2014, Rekoop in 2016, DealCloud in 2018, and OnePlace in 2019. Intapp’s Time product, automating the capture and recording of a lawyer’s activities, enjoyed considerable success in the Australian legal market but has tended to fall out of favour, partly due to the changes that have been made to pricing which has encouraged the adoption of competing products. Nor were the Australian clients of OnePlace overly pleased by the change of ownership. As Neil Blum, Head of IT at Barry Nilsson recalls, `Less than 3 months after our lengthy deployment of OnePlace CRM, we learnt about the Intapp acquisition, which was disheartening. Almost immediately after our launch, Intapp began moving customers away from OnePlace CRM (salesforce) and onto their Intapp platform.’ Evidently, such rapid ownership changes can leave customers confused and feeling somewhat frustrated.

According to McKinsey, cultural factors and organisational alignment are critical to success (and avoiding failure) in mergers. Yet leaders often don’t give culture the attention it warrants—an oversight that can lead to poor results. While 95 percent of executives describe cultural fit as critical to the success of integration, 25 percent cite a lack of cultural cohesion and alignment as the primary reason integration efforts fail. Hence the consequent clash of cultures will be a big threat to employee engagement and retention and judging by the exodus of people from many of these acquisitive companies the prospect of working for the new entity, for some, will be less attractive. The subsequent departure of key people from acquired companies suggests an inevitable impairment of client relationships in the short term.

Recent acquisitions by Morae of Phoenix, quickly followed by Trinogy Systems, have been met with limited enthusiasm by their iManage clients, who have expressed frustration with the engagement process employed by a larger company. As one CIO confides when bemoaning lost relationships with Trinogy and Phoenix, `Honestly, I'm even scared to talk to Morae about anything, because everything ends up with expensive projects/consulting fees etc’.

The Australian legal market is relatively small, and the nature of the local legal firms is often overlooked by large international vendors that try to impose the same marketing and sales strategies they employ in the US and Europe. This approach, which includes having to purchase licences for all lawyers and not just those who may actually use it, can alienate existing and potential clients and encourage a legal firm to look for a more flexible provider. The loss of existing relationships between client and vendor should not be underestimated because, as Asitha Udumalagala, Head of Information Technology at Makinson d'Apice Lawyers, observes, `the goodwill that has been built up over a long period of time can ultimately result in financial loss to an existing vendor as clients look to other partners and solutions.’

It is inevitable that there will be further consolidation of vendors within the legal sector, it is not inevitable that future mergers and acquisitions will benefit clients and employees. There is however no doubt that many clients prefer a reduction in the number of key vendors that they are dealing with and where the acquisitive companies successfully integrate their core solutions with products that are complementary, then it is a win for clients.

Mergers and acquisitions are an acceptable growth strategy and hardly confined to companies in the legal sector. Venture capital plays a valuable and leading role as the primary buyer for intangible capital such as technology. However, this means that future dealings may be governed by the interests of Private Equity (PE), rather than prior covenants casually accepted with original owners. Acquirers should therefore give serious regard to the concerns of `acquired customer’ already annoyed by dwindling alternatives and a lack of market power due to the vast size of modern tech providers.

Authored by John Duckett, Director at InPlace Solutions.

References:

Oliver Engert, Becky Kaetzler, Kameron Kordestani, and Andy MacLean - Organizational culture in mergers: Addressing the unseen forces; by - https://www.mckinsey.com/business-functions/organization/our-insights/organizational-culture-in-mergers-addressing-the-unseen-forces, March 2019.

The Economist July 3 2021Edition. Schumpeter: “Do the costs of the cloud outweigh the benefits?”

Jonathan Hasket - Imperial College London: “Capitalism without Capital”

https://www.imperial.ac.uk/be-inspired/magazine/issue-44/capitalism-without-capital/

Also Read: Positioning the Law Firm for the Next Normal and Litera Agrees To Acquire Kira Systems